Why keep administrative documents?

Most administrative documents raised over time can be useful one day or another insofar as they constitute in particular elements making it possible to prove the existence of a right or to demonstrate its good faith in the event of a dispute.

Conservation times vary depending on the nature of the parts.They are active in the duration during which a legal action can be initiated by or against the holder of these documents.Since 2008, the document retention period has been reduced to 5 years.But there are many exceptions.

Document to keep for life

Documents related to family issues must be kept permanently.This is particularly the case for civil status acts, divorce judgments or adoption judgments, marriage contracts (documents relating to goods provided or acquired during marriage by donation or legacy), wills and regulationsof succession as well as family booklets and diplomas and the military booklet.

Document to be temporarily kept

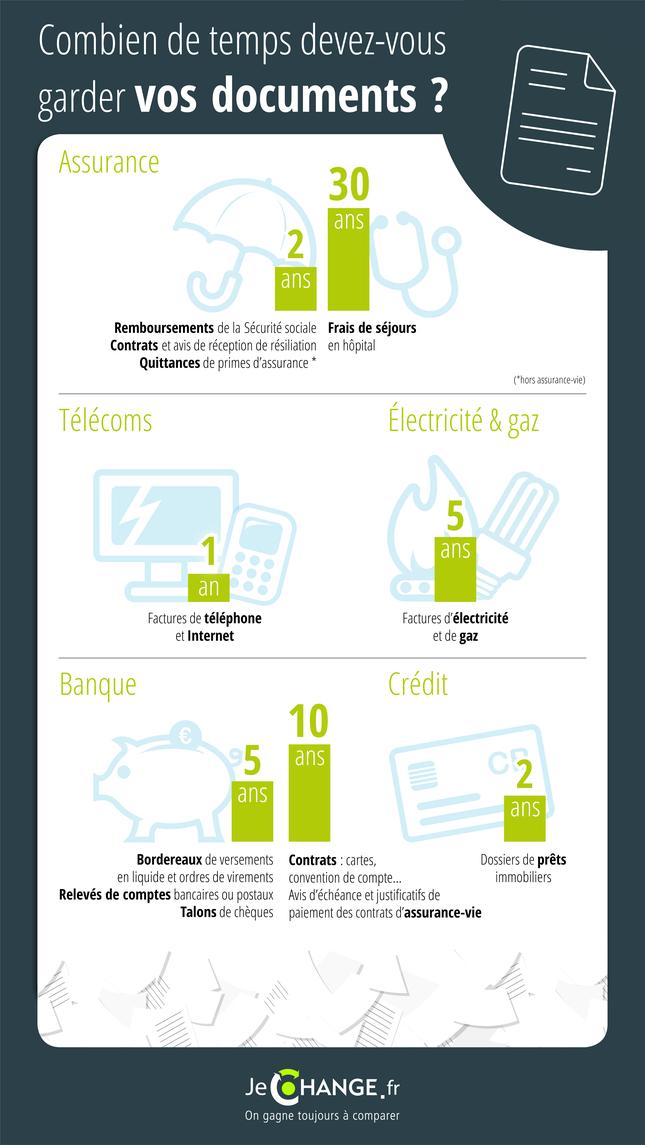

Insurance: Home insurance contracts and their endorsement endorsements are to keep 10 years after the termination of the contract.If the insured is involved in a claim that has caused serious bodily damage, the related documents are to be preserved for life.Beneficiaries of a life insurance contract must keep it for 10 years as soon as they are aware of the contract.

Housing: maturity notice, termination receipts and letters must be preserved for 2 years before recycling in a trash can.The leases, states of the input and exit, charges, rent receipts, invoices of maintenance work carried out and surety deeds are to be kept 5 years after the end of the lease.For the owners, the title of ownership is to be kept until the sale of the goods as well as the notarial documents attesting to a servitude of passage on a neighboring plot.In collective housing, co-ownership regulations, minutes of general meetings are also to be archive until the sale of the property.On the other hand, charge of charges, payment proofs, union mail can be thrown after 10 years.Ramonage certificates are to be preserved at least 1 year.

Please note: the invoices relating to the work covered by a ten -year guarantee (construction, structural work) are to be kept during the same period of time (10 years).

Vehicle: the purchase bill for a vehicle and the registration certificate (ex gray card) should be kept until the sale of a new owner.It is advisable to keep repair invoices so as to prove that the vehicle was well maintained during a possible transfer.Post-storming packages (tickets) must be put aside 1 year, or even 3 years if the infraction punished constitutes a crime (for example recurrence of a great speed).

Bank: The retention period of account statements, heels and checks for checking checks is 5 years.That of the invoices of the bank cards and supporting documents for withdrawals in the DABs, of 1 year.Same shelf life for elements relating to a closed bank account.Checks can be kept for 1 year and 8 days.Beyond this period, they can no longer be cashed in a bank account.

Credit: supporting documents for consumer or mortgage loans are to be preserved 2 years after payment of the last deadline.

Invoices: The average storage time for supporting documents attesting to payments is 2 years that it is work, a move, a gas, electricity bill.Water bills are to be preserved between 2 and 4 years.4 years if the supplier is a public or parapublic organization (management), 2 years if it is a private operator.

Telephony: Regarding the telephone and the Internet the conservation period is reduced to 1 year.

Purchase: The retention period of invoices corresponds to minimum to that of the warranty.For semi-durable or durable goods (jewelry, furniture, etc.), invoices are to be preserved without real prescriptions, because they will be produced in the event of a claim or burglary.

Taxes and taxes: Documents relating to income tax are at 4 years old, duration which corresponds to the limitation period (end of the 3rd year following that where taxation is due).

Please note: for the 2019 tax on 2018 income, the tax time for tax authorities runs until the end of the 4th year.The administration can therefore claim a tax supplement until December 31, 2022.

Likewise, the roles of housing and property tax are at 4 years old.Documents relating to donation, inheritance and IFI rights are to be kept for 7 years.

Family services: the payment bulletins of family services are preserved 3 years.

Retirement: salary slips, individual situation statements and additional retirement points should be preserved until the liquidation of rights.The receipt for balance of any account is to be kept 6 months, delay beyond which it can no longer be disputed.Subsequently, the notification of pensions and survivor's pensions are to be kept life.

Please note: ASSEDIC or Pôle Emploi certificates are to be preserved, because they are part of the calculation of retirement rights.

Health: The prescriptions are to be preserved for 1 year, 3 years for those concerning glasses.Conditions for social security reimbursements are archive for 24 months.

>> Notre service - Résiliez vos abonnements et contrats en ligne, simplement et en toute sécurité, avec envoi automatique de votre lettre en recommandé

Conservation of documents: How to find your way around?

It is generally advisable to keep your administrative papers and documents by grouping it by gender (ex: taxes, family, etc.) then placing them in colored pockets each corresponding to a theme.Thanks to the Internet, it is possible to keep essential documents dematerialized in a personal, online space, or by archiving them on a computer (with backup on an external hard drive).The dematerialized documents have the same legal value as physical versions.If they are saved online, they will be better preserved in the event of a disaster: flood, fire, etc.

>> Àlire aussi - Bulletin de paie dématérialisé

Medical deserts, public services: what assessment of Macron on rurality?

What is the best Oppo smartphone to choose?

The best phones in 2021 for photos and video

Good Plan: the recap of 4G packages on sale