Charles Prats and Virginie Pradel are both members of the Vauban Tax and Economic Research Institute, which brings together practitioners and citizens interested in tax issues.

The CNIL has expressed concern about the government's new system to fight against tax evasion. Device which provides for a massive collection of data from Internet users on social networks. Do you share the CNIL's point of view?

Virginie Pradel:

The device voted is draconian and disproportionate, even taking into account the amendments adopted to water it down. The public personal data of millions of citizens (in particular their photos on instagram or facebook) can now be systematically vacuumed, in order to flush out some misguided tax evaders. Did the fight against tax evasion justify putting all citizens under generalized digital surveillance? The answer is definitely negative.

We have an unfortunate tendency in France to consider that the end always justifies the means. However, the means here appear extreme to achieve the desired end: improving the targeting of tax audits. Especially since the tax administration already has an impressive arsenal of surveillance and investigation. It has already been using artificial intelligence for several years to exploit the data collected by public administrations. She can also monitor taxpayers on social media if needed. The government's objective is to transform this artisanal surveillance, which today is exercised on a case-by-case basis, into mass industrial surveillance. In defiance of the freedom of citizens.

The fight against tax evasion, certainly a laudable objective, has been instrumentalized to justify an unjustifiable system. The government has clearly used and abused a legitimate concern of the French to impose on them a device that directly infringes their privacy.

It is regrettable that this device was voted in haste by our parliamentarians and in spite of the concerns raised in the opinion of the CNIL. The establishment of such a system would have deserved to be the subject of a real public debate. We bet that this device will be censored by the Constitutional Council.

Charles Prats:

This is indeed a questionable provision. If it is a question of counting the sales on the platforms of e-commerce and cooperative transactions, why not. This is no different, in spirit, from the control of the minutes of voluntary sales which were formerly systematically transmitted to the tax authorities by the auctioneers.

On the other hand, concerning the collection of data on what are called social networks - Facebook or Instagram for example - this raises many more ethical and technical questions.

I myself as an investigating judge, for example, used photos published on Facebook in the context of Subutex trafficking linked to social fraud organized with diversion from the CMU-C and the AME, which shed light on the personality of the alleged perpetrators. In this case the individual had photographed himself with a large pile of white powder in front of him... Very interesting element. But it was punctual with a targeted search and it only constituted an element of environment and not a "hard" proof because I had no real element on the exact nature of this white powder.

Conversely, this new tax system consists of a generalized aspiration of data then processed by algorithm and which we can guess will eventually be used as evidence of a lifestyle that is difficult for the taxpayer to combat.

In any case, if the government wants to be consistent, it must "at the same time" extend the system to the fight against social fraud in benefits and contributions because in this area, on the other hand, conclusive elements can be gathered on social networks, for example to fight against residence or activity fraud. At a time when the mission on social benefits fraud has assessed the amount of this at 45 billion euros per year, the stakes appear to be even more important than tax evasion of income tax or even VAT which are obviously in the line of sight of the tax monitoring system of social networks.

Do you think there is a risk of drift?

Charles Prats: The risk of a disproportionate invasion of privacy is evident with the establishment of this massive surveillance. But it is the corollary of what citizens themselves post on social media about their lives.

Beyond the potential abuses linked to the effective retention of data and their use for purposes other than tax by services other than customs or taxes, the main pitfall that I see in this massive collection of data is that of the propensity of people to "invent a life" on Instagram or Facebook. How many photos of people driving luxury cars or posing on boats, dream objects but which they do not actually enjoy except for the time of a loan or a brief rental? The prism of social networks is very strong: at Loto Instagram almost everyone has earned a living as a billionaire. If the administration begins to want to tax people on the basis of what it will collect on social networks, we will have created a new tax: "the mytho tax"! Sitting on the life that people dream of, they give themselves the impression of caressing the fleeting time of a photo published on the Internet. We would then be heading for major disappointments...

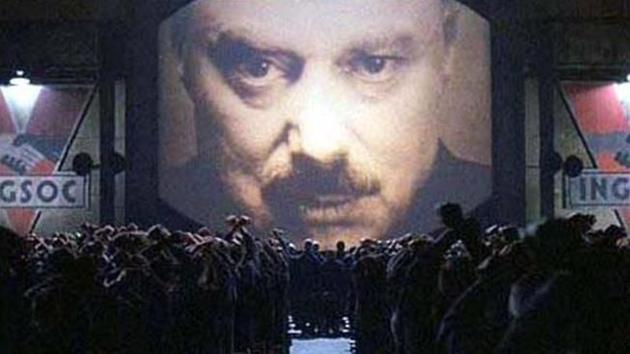

Virginie Pradel: It's obvious! Moreover, the general and prior aspiration of taxpayers' public personal data, in the name of the fight against tax evasion, already represents a liberticidal drift. This should have been highlighted more. The National Assembly has opened Pandora's box of generalized digital surveillance. After the fight against tax evasion, what will be the next reason invoked to justify the aspiration of taxpayers' personal data: the fight against racial discrimination, the fight against sexism or even the fight against fake news? If we continue on this liberticidal path, France risks transforming itself in the coming years into a "mini-China"... We must fight against the excesses of the State, which tends more and more to exercise illegitimate control over citizens' lives in the name of 'efficiency'. It's dangerous because, as George Orwell wrote in 1984, "dictatorship can take hold quietly."

The National Assembly also adopted this week a series of measures concerning tax informants. What do you think?

Virginie Pradel: Remember that this is an old practice. The French tax administration for a long time had recourse to this opaque practice, devoid of any legal basis, until the latter was officially abandoned by Nicolas Sarkozy in 2004. It was subsequently gradually institutionalized. Article 109 of the Finance Act for 2017 (introduced discreetly by way of amendment) first authorized the tax administration, on an experimental basis for a period of two years, to compensate advisers providing it with information that led the discovery of a case of international tax evasion. The system was then made permanent in 2018 during the review of the law on the fight against fraud (article 21 of law no. 2018-898 of October 23, 2018).

Although tax disclosure can be socially useful, the remuneration of tax advisors should be strictly regulated and limited. This practice is indeed likely to generate many adverse effects, including a climate of permanent and worrying suspicion as well as the birth of new vocations of tax advisors, given the expected gains. It should be noted that remuneration for tax disclosure has been implemented in several States (about ten according to the information report of June 5, 2019 relating to tax advisers), including the United Kingdom, the United States, the Canada, Belgium, Denmark, India, Germany and South Korea. Other states, however, refuse to remunerate tax informants (at least officially), including Austria, Spain, Greece and Portugal. In the states where it has been introduced, it can be very profitable, particularly in the United States where advisors can be awarded a bonus that can represent up to 30% of the sums recovered by the tax authorities. For example, the former wealth manager, Bradley Birkenfeld, recently received a super bonus of 104 million dollars in reward for his revelations about the unscrupulous practices of the bank UBS.

The fact of remunerating tax advisors more is highly questionable and raises several questions, including that of its justification. Indeed, if the current ceiling of one million euros (already generous) can be seen as intended to compensate tax advisers for the risks incurred or the material consequences suffered, what is the justification for a substantially higher remuneration? Moreover, how to justify the significant difference in treatment between, on the one hand, unpaid whistleblowers, and on the other hand, overpaid tax advisers with regard to the service provided? Finally, one may wonder why the generous remuneration of advisors should be limited to tax matters. Wouldn't it be appropriate to adopt a similar system for social advisers who would be called upon to denounce social fraud?

Charles Prats: At the risk of shocking, I am very much in favor of paying tax advisers, as already exists in customs matters. And I am also in favor of significant remuneration, proportional to the amount of sums recovered thanks to the information given. Basically the same system as in the United States. You don't catch flies with vinegar and when it comes to major organized tax fraud, you need human intelligence in addition to technical intelligence. And when it comes to human sources, the financial motivation remains the easiest to manage for the services: things are square when the informant is only guided by the expectation of financial gain. When other motivations are invoked, the officer in charge must immediately have alarm signals in his mind because this is the harbinger of many worries... The few recent cases have demonstrated this, leaving in the end alerts demolished professionally and personally. I take this opportunity to be surprised that it is announced that it wants to remunerate future advisers correctly while not taking the trouble to deal with those who in the very recent past have enabled the State to obtain important results...

However, the issue of tax secrecy vis-à-vis the advisor will have to be resolved. Because if he does not know the amount of the adjustment made thanks to his information, the tax secrecy being opposed to him, he will not be able to verify the accuracy of the amount of the proportional remuneration to which he will be entitled. The advisor and the administration must work in trust. But trust does not exclude control, especially in these matters.

What do you think of all the measures relating to tax audits adopted since the start of the five-year term?

Charles Prats: They are marked by an obvious imbalance to the detriment of litigants. Improving the mechanisms for combating tax evasion is a necessity, which I have personally carried out for several years, being in particular at the origin with the lawyer - and deputy at the time - Yann Galut and the journalist Antoine Peillon of what will lead to the law of December 2013 on the fight against tax evasion and serious financial crime and having launched and carried the fight for the opening of the "Verrou de Bercy" since 2012 with in particular the senators Nathalie Goulet and Eric Bocquet.

But unfortunately all the proposals for improving the rights of the defence, an essential corollary, have been written off. With the growing penalization of tax law, a worrying mechanism has been put in place. It is urgent to rebalance the procedures because the current situation is very unsatisfactory, especially with the reform of the penal sanctions for tax evasion which should oblige, in all rigor, to determine with precision the amount of the defrauded sums before pronouncing the incurred fine. This refers to the problem of the duality of jurisdictions, administrative and judicial, and to the current lack of coordination between the tax judge and the criminal judge. The Senate had adopted intelligent measures to regulate these questions, the National Assembly swept them away at the request of the Government, that is to say of the tax authorities. That's a shame...

Virginie Pradel: Since the start of the five-year term, we have witnessed a continuous strengthening of the powers of investigation of the tax administration and the criminal sanctions imposed on taxpayers. This reinforces the asymmetry that already existed between the rights of the tax administration and those of taxpayers. The government cleverly justified this reinforcement by introducing a new right granted to taxpayers: the famous “right to make mistakes”. However, the latter is nothing more than an (excellent) political communication stunt. Let it be said: the “right to make mistakes” now benefits the tax administration more (to cover up its own errors!) than the brave taxpayers who continue to suffer from tax complexity.

Ultimately, French taxpayers have gained almost nothing, but have on the other hand lost a great deal since they are now subject to increased double surveillance. First of all, a "vertical" surveillance by the State which considerably reinforced its powers. Then, “horizontal” monitoring by other taxpayers who can now hope to enrich themselves if they discover the existence of tax evasion. It goes without saying that with such measures, the French tax climate risks becoming more and more anxiety-provoking and harmful in the future.

DIRECT. Assassination of Razia Askari in Besançon: "No guilt, no remorse, lack of empathy", the profile of Rashid Askari, accused of the assassination of his wife, dissected

Samsung AU9000 Test | TechRadar

[Video] The Amazing Spider-Man 2: the ultimate trailer

Nantes. He had assaulted a tram driver: sentenced to 6 months, he avoids prison