Some administrative records must be kept for life, others have shorter retention periods provided for in the regulations.

Family: all life

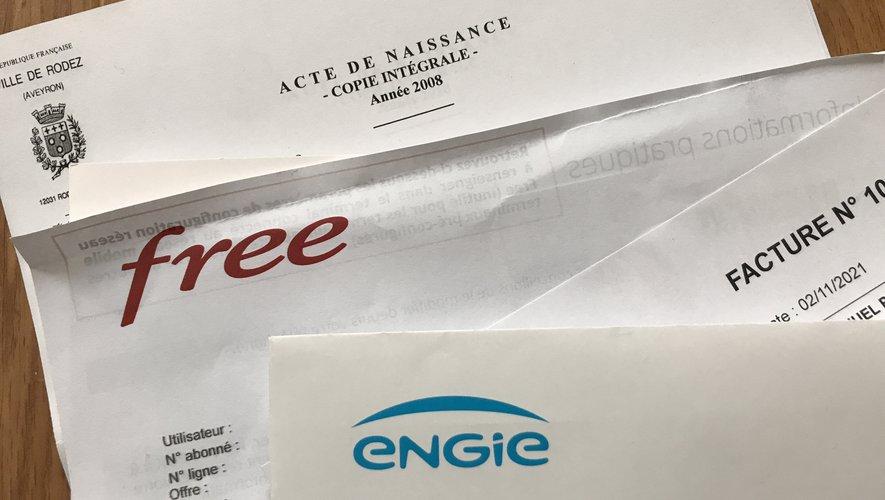

Records relating to family issues must be kept on a permanent basis in most cases. This applies in particular to:-civil status documents (full copies and extracts)-divorce or adoption judgments-marriage contracts (documents relating to property brought or acquired at the time of marriage by gift or bequest)-family books-diplomas.

Insurance: from 2 to 10 years

With regard to insurance, receipts, notice of expiry, letters of termination must be kept for 2 years from the date of the document, as well as the insurance contract.

Life insurance contracts must be retained for 10 years by the beneficiary of the insurance as soon as he becomes aware of the contract.

Invoices: from 1 to 5 years

Electricity and gas bills must be kept for 5 years, as well as water bills. For landline, mobile and Internet subscription, it is 1 year.

Accommodation: from 3 to 5 years

Proof of payment of condominium charges, correspondence with the trustee, minutes of condominium general meetings must be kept for 5 years.

Rent receipts, rental contracts, records of the premises must be kept 3 years after the term of the rental. These time limits apply to dwellings rented as a principal residence, empty or furnished.

Work: until retirement

Salary slips, employment contracts and certificates of employment must be retained until retirement has been completed. The Employment Centre certificates must be retained until unemployment benefit is obtained. These documents are also useful in calculating pension entitlements.

Taxes: from 1 to 3 years

Your tax returns, tax notices, and supporting documents used in your taxation (for example, proof of actual fees) must be kept for 3 years.

Local tax notices (property tax and housing tax) must be kept for 1 year.

Medical deserts, public services: what assessment of Macron on rurality?

The best phones in 2021 for photos and video

What is the best Oppo smartphone to choose?

Good Plan: the recap of 4G packages on sale