Among the new features presented during the keynote, Apple Pay may be the most important in the long term. Apple is very ambitious with this project which must retire the traditional wallet and offer iPhone users a simple, fast and secure way to pay. The service should be used as much at the checkout of physical stores as on the internet and if it is reserved for the United States at launch, it will eventually be available everywhere.

How does Apple Pay work? We take stock…

Easier and faster

During the conference, Tim Cook did not hesitate to describe current bank cards as antiques, with their 50-year-old magnetic strips. And the boss of Apple has listed all the shortcomings of this means of payment: these pieces of plastic take up space, they are complex to use and unsafe.

This is particularly the case in the United States, where we often have several payment cards, and where the chip on our European credit cards does not exist. But even with a chip, all the information needed to use a card—namely the user's first and last name, card number, and the "secret" number on the back—is easy to retrieve and exploit. .

To illustrate the simplicity of Apple Pay, the manufacturer simulated a purchase before and after. Magnifying (slightly) the feature, the version without Apple Pay involves rummaging through a purse, then looking for and taking out the right card in her wallet, then giving her identity card, the saleswoman must then pass the card in his machine, you still have to retrieve the card and the payment receipt and only then can you retrieve your purchases.

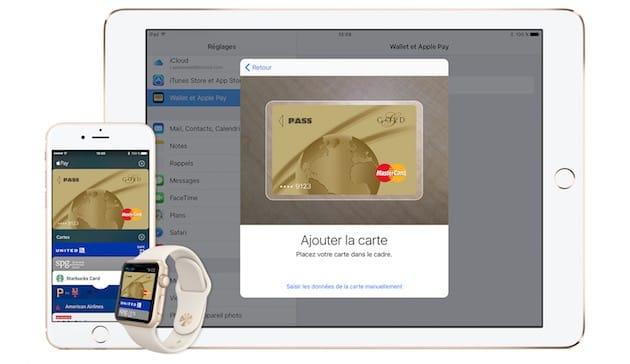

In comparison, Apple Pay is supposed to be much simpler: you take out your iPhone 6, approach it to the payment terminal while holding a finger on Touch ID and… voila. The NFC chip takes care of making the link and transmitting the information to make the payment, without any further action on its part. It's not only simpler, it's also much faster, especially if you use an Apple Watch (we'll come back to this).

All transactions made with Apple Pay are available in a history and iOS 8 will display a notification after each payment. There is therefore no need to keep the receipts that are traditionally handed to you after a purchase...

More secure

During the conference, Apple put a lot of emphasis on the security of Apple Pay. The system is reserved for the two iPhone 6s, not only for Touch ID, not even only for the NFC chip which allows contactless transactions, but also for the addition of a chip dedicated exclusively to payment security.

Security therefore involves a few key points:

Furthermore, Apple Pay is a service that respects your privacy. Eddy Cue did not fail to recall last night that the company does not earn a living with the data of its users - a spade against its main competitor, no doubt - and the manufacturer therefore has no access to any given. Apple does not know when you buy, what you buy and how much the purchase cost you: in theory, everything is done exclusively between you, the merchant and your bank.

Better, the cashier doesn't know anything about you either. In a traditional exchange, at least the last name is known to the merchant who retrieves the bank card to make the collection (on this side of the Atlantic, the buyer often does everything himself). Sometimes, an identity document is requested to reinforce the controls.

With Apple Pay, Touch ID does the work of verification and the customer must therefore remain completely anonymous. Only one piece of information can be transmitted in plain text, the postal code; everything else is encrypted and the merchant has no access to it. By the way, we thus avoid the theft of credit card numbers which can have serious consequences if the control number, at the back, is also recovered.

If the iPhone is lost, the data can be deleted remotely, using the Find My iPhone service. Since payment cards are only saved locally, in the phone's dedicated chip, there will be no need to block your bank card with your bank. Incidentally, such sensitive data is never stored on iCloud, not even in the event of a backup of the terminal: this should reassure all those who were worried about the security of the service after the leaks of photos of stars.

Thus, Apple Pay is more secure than payment with a physical bank card. In theory, you can just keep the iPhone with you and leave the cards at home, in a safe place. Of course, for this to be possible, you have to be able to pay with the service everywhere, and this will certainly not be the case at launch…

For whom and for what?

If you don't live in the United States, Apple Pay will remain very theoretical for you. Apple focused on its local market first, and the company got it right by ensuring that over 80% of transactions were compatible.

On the program, the three main types of bank cards, the biggest banks and also the biggest merchants in each category. From McDonald's (including the Drive!) to Macy's and Whole Foods, via Disney and Staples, without forgetting the Apple Stores of course, Americans will have enough to test the system.

In addition to physical stores, Apple Pay can also be used to make purchases on the internet. If necessary, you no longer need to fill in the payment information, but you can also do without your address or other personal information: everything is transmitted automatically. At the moment, you can't use the service anywhere, just using a browser on your iPhone 6.

The manufacturer reserves its payment service for App Store developers who will be closely monitored if they want to use this payment method. Moreover, the first condition for using it is very clear: Apple Pay is reserved for the sale of physical products. For the rest, there are always in-app purchases. Eddy Cue gave a few names, however, such as Target, Groupon or even MLB which will allow you to buy tickets for baseball games, or even the OpenTable reservation service for a restaurant.

Everything is done in one tap, with a dedicated button, and in some cases, you can even save time by not creating an account. This is the case with Uber, which can now only work with Apple Pay: at launch, you can indicate that you want a car without creating an account, and payment is then made with Apple's service. For restaurants that accept reservations through the OpenTable site, you can even pay the bill at the end of the meal using the service.

Elsewhere in the world, it is more complicated. Apple hasn't announced anything specific: after the US launch in October, the company is supposed to be "working hard" to launch Apple Pay in the rest of the world. Nothing is done, but the manufacturer is certainly more motivated than normal. Indeed, Tim Cook can well explain in an interview that the financial aspect is not essential, the fact remains that Apple will earn money for each transaction carried out with Apple Pay.

Of course, the service is free for the customer who makes a purchase, for the developer who integrates it into his application, or for the merchant who accepts it in his shop (in this case, the banks will take the usual fees for the deal). However, Apple should take a portion of each transaction from the banks. The information remains conditional, because it has not been confirmed and we do not know the rates, but it seems certain that agreements have been signed to this effect.

Even if the rate charged by Apple is extremely low, it is a financial windfall that will necessarily interest the company, especially since if Apple Pay is successful, it could represent substantial sums. Better, the company has nothing to do to earn this money, and it is a way of continuing to charge its customers, without them noticing.

Under these conditions, we can think that the international deployment of the service will be much faster than with iTunes Radio, for example. Especially since finding an agreement will certainly be easier with the banks than with the major record companies.

Paying with your watch

Apple Pay will initially be reserved for the iPhone 6, but the manufacturer has also planned to add this payment service to its connected watches. You can simply wear your watch near the payment terminal to make a purchase, without even having to take your phone out of its protection. This will be practical in case of bad weather, or simply to go even faster.

In the absence of a Touch ID sensor, the operation is a little different, however. The payment service first requires the creation of a code (probably four digits) which will be requested for any transaction. As a security measure, the transaction is validated if three conditions are met:

Combined, these two precautions prevent NFC “theft”: no one can force you to make a payment by passing a device near your watch. The Apple Watch remaining on the wrist all day, it was a risk, for example in public transport.

The code requested before each transaction is a security, but a security that seems very light compared to what the iPhone 6 offers. However, the association with its iPhone adds an additional security measure. If the watch is too far from his phone, the transaction will probably be impossible.

Note also that the watch is only capable of making physical payments, in stores: in the applications, you will necessarily need an iPhone 6. However, it is an excellent solution to popularize the payment service more quickly. : at $350 minimum, Apple will be able to convince more people than if the purchase of a new iPhone were compulsory.

The Apple Watch is not expected before 2015. If the payment service is available in France on that date, you can then use your watch to pay. Welcome to the future.

DIRECT. Assassination of Razia Askari in Besançon: "No guilt, no remorse, lack of empathy", the profile of Rashid Askari, accused of the assassination of his wife, dissected

Samsung AU9000 Test | TechRadar

[Video] The Amazing Spider-Man 2: the ultimate trailer

Nantes. He had assaulted a tram driver: sentenced to 6 months, he avoids prison